The management of internet providers (ISPs) can certainly get great benefits from hiring a tax audit to ISP .

Especially when the goal is to maximize the benefits of added value services (SVA) to provide tax economy .

In other words, the idea is to pay less tax from the strategic management of SVA solutions for internet .

A tax audit for ISP, as a result, should enhance the business model and optimize the management and management of internet providers.

Why choose a tax audit for ISP?

In principle, because a tax audit for ISP leaves owners and managers of internet providers with better and more assertive information on the tax and tax issues of your business.

Above all, because a tax audit for ISP allows effectiveness in making strategic decisions and the tax management of SVA solutions for ISP .

Certainly, effectiveness is a concept that reaches three dimensions that are very interested in the management and management of the internet providers business and, in fact, any company: costs , results and impacts .

In this sense, the contribution of a tax audit to ISPs management begins to be clear. In short, it is auxiliary and facilitating the lives of managers when enhancing the benefits of SVA solutions for internet provider .

Because an ISP SVA should always be a useful, profitable and profitable solution for internet providers of all sizes (small, medium and large).

After all, unlike SCM (Multimedia Communication Service), SVA solutions for ISP have reduced tax burden . Not paying ICMS means a huge tax reduction.

Then the other reasons for choosing a tax audit for ISP have already been deepened in our previous SVA articles for internet provider .

Learn more at Lumun Blog :

- Brazilian startup launches new SVA for internet providers

- What is an SVA? (Value Added Service)

- Lumiun ISP is an SVA for Strategic Value Provider

- Why do providers are looking for SVAs?

- What are the benefits of having an SVA for ISP?

- Lumiun ISP

Tax Audit for ISP: More SVA, Less Tax

Taxes are responsible for much of the costs of Brazilian companies.

In fact, when it comes to tax burden on telecommunications, Brazil is among the countries that charge the most taxes on the activity. Especially on multimedia communication services (SCM) .

This is why SVA solutions for ISP are determinant for the growth, transformation and evolution of the business model business model.

In this sense, a tax audit for ISP assumes relevance to the management of the internet access supply business .

In fact, they are the great benefits of an ISP SVA solution that explain why Internet providers are looking for STAs . Especially because they allow tax reduction.

The Brazilian tax burden on telecommunications

At the end of the first quarter of 2021, the National Telecommunications Agency (Anatel) released the International Comparative Study of Tax Load Level Report and Cost of Service Basket .

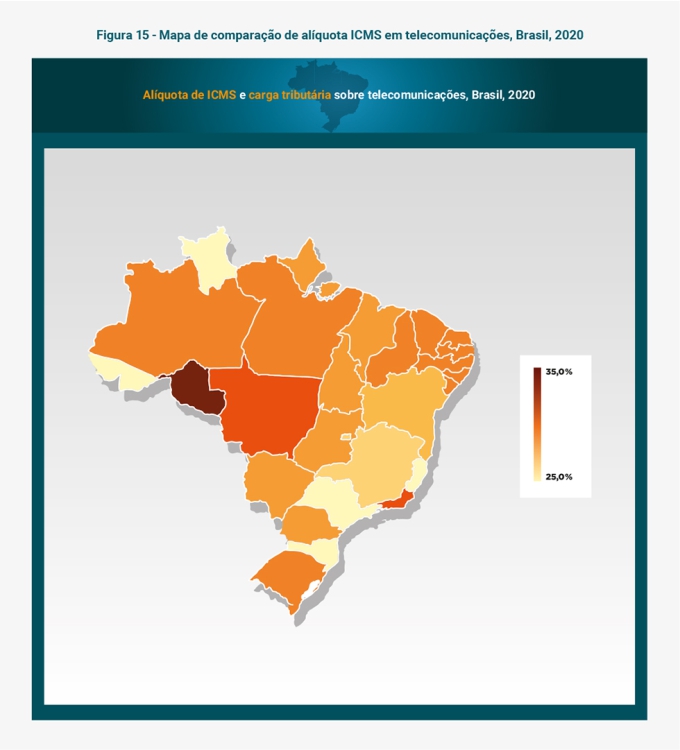

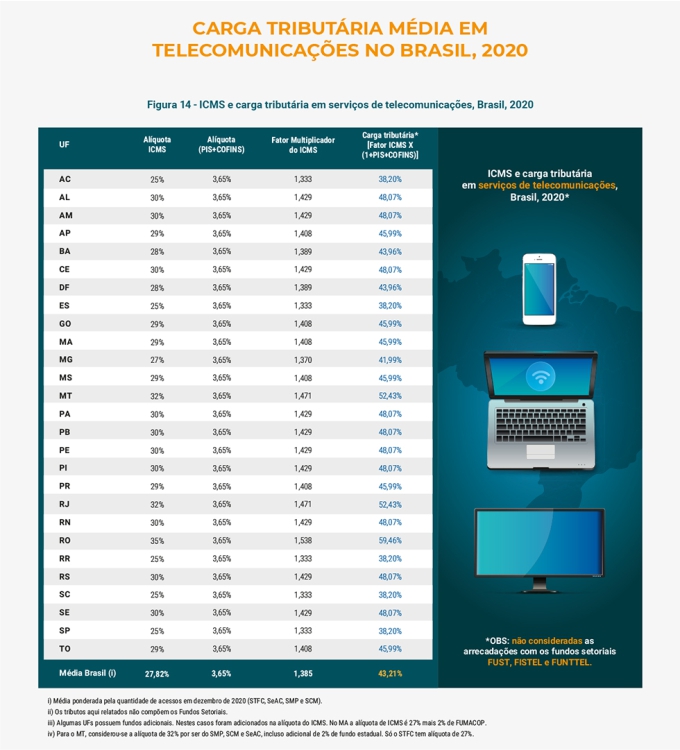

According to the Anatel document (on pages 7, 17 and 18, reproduced here), we can see the tax voracity of the Brazilian State. Between 2018 and 2020, a 0.4% increase in the ICMS tax burden . Which raised the average rate of telecommunications services to 43.6%.

Report Highlights (Page 7)

- Brazil has improved its position in the telecommunications services basket ranking. In mobile telephony Brazil was in 83rd position and rose to the 63rd. In a fixed broadband Brazil evolved from 75th to 45th position.

- Brazil continues with a high relative tax burden on telecommunications compared to other countries. In mobile telephony Brazil is in the group of 5% of countries with the highest tax burden, and in fixed broadband Brazil has the highest ranking in the UIT ranking.

- Brazil is the 6th largest market in mobile telephony in the world and the 5th largest national broadband market . Highlight for China, which already has 39% of the worldwide fixed broadband market.

- From 2019 to 2020, in the analysis by UIT, there was a dynamic of higher concentration of countries in lower tax burden. Specifically with a percentage increase of countries with a tax burden of 0% to 10% and a percentage reduction of countries with a tax burden of 10% to 20%. This migration of tax load ranges took place in both services: mobile telephony and fixed broadband.

- From 2019 to 2020 the average tax burden in Brazil increased by 0.4%. This is due to two factors: i) increased national average ICMS by 0.22% due to an increase in the rate of a state, ii) new statement of states due to altering the number of accesses. The AD Valuem Average Telecommunications tax burden for the Brazilian consumer is around 43.6%.

- São Paulo has 31.26% of the National Telecommunications and Minas Gerais market has 9.62% of the market. The other states account for about 60% of the domestic market.

- The costs of service baskets , both in mobile and fixed broadband, hardly changed , considering the 2018 and 2019 data.

- Note a consistent drop in service basket prices measured by UIT, both by per capita GDP and US $ in power and purchase parity (PPC). This trend remains for 2019 data, even with some changes in UIT service baskets. Current service baskets have services that reflect the recent reality of users with an increase in capacity for use.

Complexity of the tax burden for internet providers

In order to facilitate understanding of the complexity of the tax burden on ISPs and SVA solutions for internet provider, we suggest watching short videos that accountant Stanley Souza makes available on Youtube .

Just to illustrate our theme here, we make available the video 06 - which taxes my provider must pay .

SVA solutions for internet provider to optimize the tax burden

As we have seen, the SVA (added value service) has lower taxation than the Multimedia Communication Service (SCM). Also, that the Brazilian tax burden on telecommunications is one of the highest in the world .

Just to exemplify, imagine that a provider sells your internet service for $ 100.00 . As a result, it pays state and federal taxes on all this value.

Now, see the "magic" happen.

By adding a SVA benefit to the customer in the amount of R $ 20,00 , and maintaining the R $ 100,00 of price to the subscriber, the provider will pay federal taxes to both services. However, at the state sphere (ICMS), it will only focus on R $ 80.00 .

Thus, it is possible to decrease the value of the state tax by offering an SVA solution to ISP to the internet provider's plans.

But, be very careful. Consult your accountant or legal advisor to verify the rules and limits of values that are allowed not to have tax problems.

SVA + Tax Audit for ISP = Effective Tax Planning

Above all, the main advantage of a tax audit for ISP is to enhance the SVA Solutions Tax Economy for Internet Provider.

And also contribute to effective tax planning . This will undoubtedly make it possible to pay less taxes, increase business profitability and improve profitability.

That's why the SVA Combo for Internet Provider + Tax Audit for ISP + Tax Planning is indispensable and so effective - efficiency and effectiveness at the same time - for the ISP business model.

How to choose a tax audit for ISP?

Surely, after so many arguments and information about the value and relevance of a tax audit to ISP , it is easy to answer that question.

To choose a tax audit for ISP, internet provider managers must prioritize qualified companies and trained professionals when hiring the service.

The concern should be to invest in quality and effectiveness. Undeniably, the right way for greater impacts, better results and lower costs when enhancing the benefits of SVA solutions to ISP and increasing the profitability of internet providers .

A good SVA solution for ISP

Lumiun ISP is an internet provider SVA that offers competitive advantages , differentials and benefits for ISPs and their customers.

The SVA format DNS filter for Lumiun ISP is designed to offer more safety and control on the subscriber and increase the profitability of providers.

Strategic differentials and competitive advantages of Lumiun ISP :

- Tax Optimization.

- Increased profitability.

- Innovation and competitive differential.

- Portfolio diversification.

- Reduction of harmful traffic.

- Less demand for support.

Lumiun ISP: Main characteristics

- DNS with low latency.

- Integration with ERP.

- White label (fully customizable).

- Responsive control panel.

- Dedicated server or VM of the provider.

- DNSSEC Support.

- IPv6 support.

Talk to a consultant and request a demonstration.

Be aware of the next contents about SVA solutions for internet provider.

- SVA Package Billing Strategy

- Useful Svas Tips for Internet Provider (ISP)

- The importance of tax planning for providers (ISP)

- Marketing tips for internet providers

Subscribe to our newsletter and receive news and materials about SVA for internet providers, technology and security on the internet.